%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

The Forum held its inaugural meeting in April 2020 and is jointly chaired by the Deputy Governor, Sam Woods of Bank of England (& PRA), and Nikhil Rathi, the CEO of the Financial Conduct Authority. Forum members include:

- Bank of England

- Prudential Regulatory Authority

- Financial Conduct Authority

- Payment Services Regulator

- Competition and Markets Authority

- Financial Reporting Council (joined April 2021)

- The Pensions Regulator (joined Sept 2020)

- Information Commissioner’s Office (joined Sept 2020)

- HM Treasury (observer)

Whilst the Forum does not have any policy decision-making responsibilities, it does produce a key document for the financial services industry: the Regulatory Initiatives Grid.

The Grid was introduced in 2020, was piloted for a year and is published at least twice a year. It provides an overview of the regulatory pipeline over a 2-year period and is now set to be the mainstay of UK regulatory landscape.

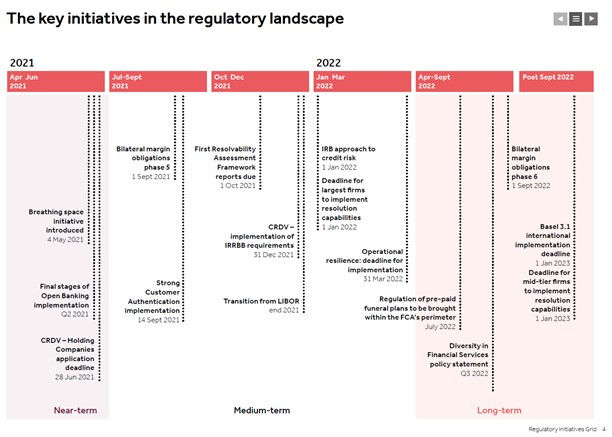

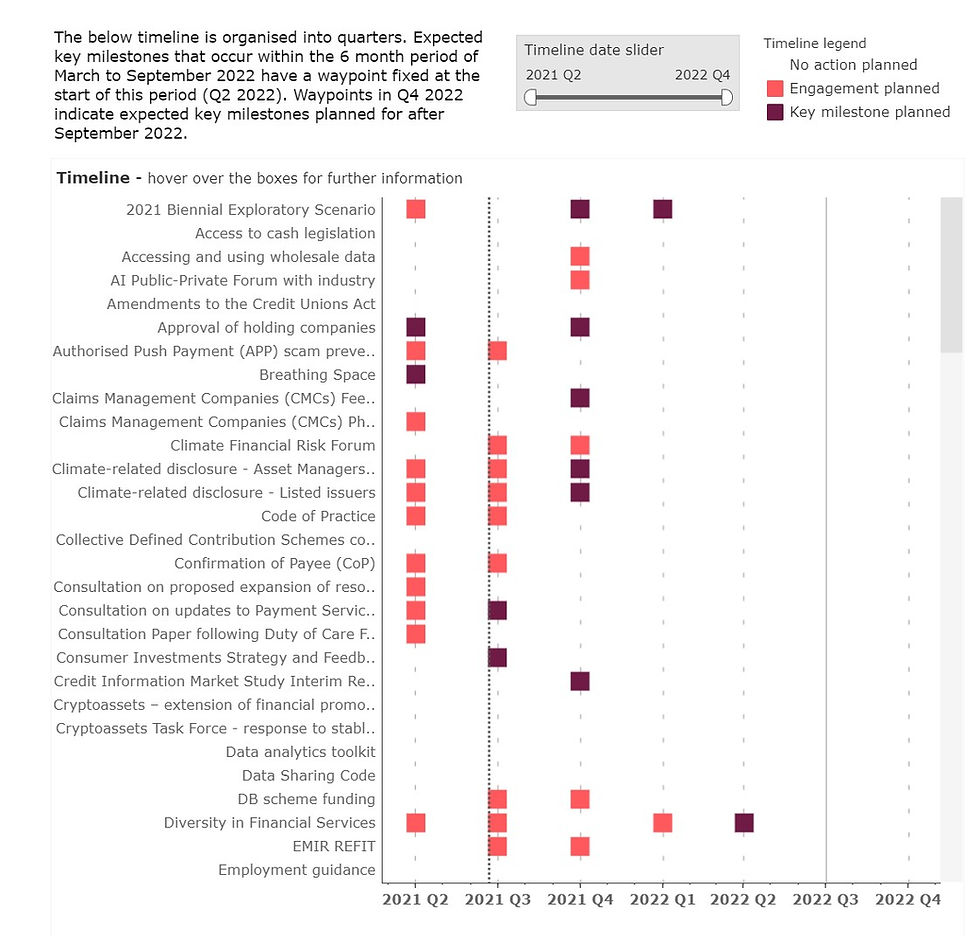

Example of the pipeline: Regulatory Initiatives Grid, May 2021

The Grid is available online and also has an interactive dashboard which enables firms to easily filter by sector or regulator to identify key milestones and initiatives.

This review led by the HM Treasury is a long term initiative looking at how the UK regulatory framework needs to adopt for the future. The first consultation closed in February 2020 and we can expect a second consultation to be published later in 2021.

Operational Resilience:

A key area for many firms due to the new requirements published in March 2021 and an implementation date of 31 March 2022. A further consultation paper is due in Q4 2021 outlining proposals for incident reporting.

Conduct:

Under the subject of Conduct, we see the Information Commissioner’s Office updated its International Transfers Guidance as well as its Data Sharing Code and Guidance on Binding Corporate Rules.

Relating to the Senior Managers and Certification Regime, the PRA’s findings relating to its evaluation in Q2 2021. This could lead to policy proposal and further consultation.

How can we help?

Ruleguard has a range of tools to help firms fulfil their obligations. Click on the links below or contact us for further information.

Tel: 020 3965 2166 or hello@ruleguard.com

Operational Resilience: https://www.ruleguard.com/operational-resilience

Senior Managers and Certification Regime: https://www.ruleguard.com/smcr

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)