%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

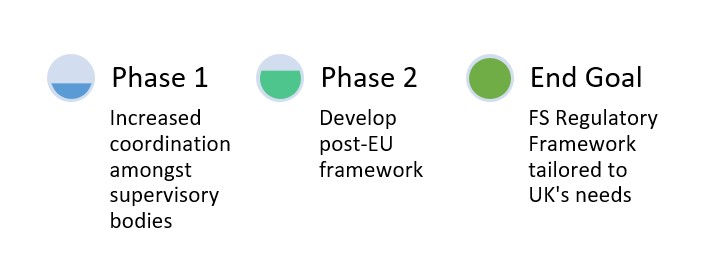

The Financial Services Future Regulatory Framework (FRF) Review was launched by the HMT in 2019. Its purpose was to consider the longer term strategy for the financial services (FS) sector and create a framework for life after the EU.

Consultation is taking place in two phases. Phase I focused on the coordination of efforts amongst the relevant supervisors. As part of this review, we saw the implementation of the Financial Services Regulatory Initiatives Forum and its publication of the Regulatory Initiative Grid.

HMT published a Phase II consultation in October 2020 focusing on the UK’s future framework post-EU. Its aim is to provide a framework for the FS regulation where responsibility is split clearly between Parliament, Government and the FS regulators.

There will be a focus on accountability, scrutiny and public engagement. Parliament and Government set the policy framework with the supervisors designing and implementing the regulatory standards. The aim is for greater transparency on how public policy issues have been considered. This message is echoed in the business plans issued by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

The consultation closed in February 2021. Since then the PRA and FCA have both now issued their business plans for 2021-2022 where they have outlined their priorities and areas for future development. Last year both regulators focussed on dealing with COVID and ensuring markets continued to work. It’s now time for business as usual, which means a re-prioritisation of some work whilst pushing forward with some key initiatives.

Sam Woods, CEO of the PRA, indicated that the PRA would seek to strengthen its approach to risk, and would work with the FCA and internationally to avoid inadvertent conflicts in supervisory approaches.

https://www.bankofengland.co.uk/prudential-regulation/publication/2021/may/pra-business-plan-2021-22

https://www.bankofengland.co.uk/prudential-regulation/publication/2021/may/pra-business-plan-2021-22

- To adapt to its role post-Brexit where the PRA will have power to set supervisory rules. Unlike the FCA, the PRA has not had to fulfil this responsibility, it will now consider how to manage this new task.

- The PRA like the FCA will promote the use of data and technology and has set up a new team, RegTech, Data and Innovation Division. Its purpose will be to improve PRA’s use of AI and machine learning as well as to enable more research into advanced technologies.

Sector Activity:

The PRA will continue with its work on prudential resilience to build a simpler prudential framework for the small non-systemic banks and building societies.

Also on the agenda, is the review of Solvency II for insurers. PRA views this as an opportunity to tailor the regime towards the UK market. Internationally, the PRA continues to work with the International Association of Insurance Supervisors (IAIS), including development of the Insurance Capital Standard and the Holistic Framework Implementation Assessment.

PRA also hopes to publish its final policy on the supervision of international banks operating in the UK during the summer 2021. It announced its intention to consult on the implementation of Basel 3.1 ahead of the BCBS deadline of 1 January 2023.

In addition to the above, the PRA is set to continue its progress in the following areas:

- Climate work

- Stress testing

- Transition from LIBOR

- Implementation of the Resolvability Assessment Framework

The Financial Conduct Authority

The FCA issued its business plan on 15 July 2021. The plan includes familiar cross sector themes relating to: fraud, financial resilience and operational resilience as well as diversity and inclusion, sustainability and international cooperation. It also echoed The Chancellor’s speech at Mansion House earlier in July.

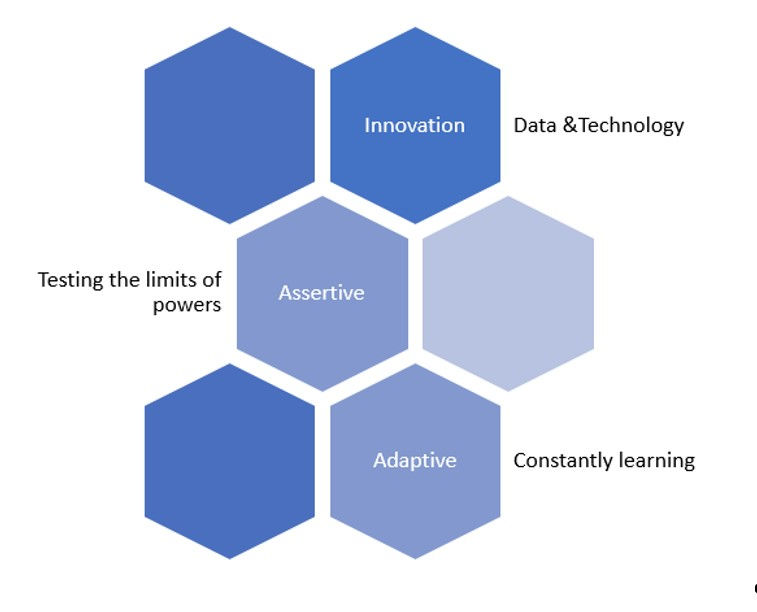

FCA’s CEO, Nikhil Rathi, also announced that the FCA is changing to better reflect the UK and it intends to be more innovative, more assertive and more adaptive in its approach.

More Innovative:

FCA highlighted that it has seen an exponential increase in the data which it analyses and can only see this increasing.

The FCA aims to automate more data collection to enable better analysis. Over the next 5 years, the FCA aims to become a data regulator, a term used to describe how it will embrace technology to improve data efficiencies.

It will invest £120million over the next 3 years with plans to move to the Cloud and become the first regulator in the world to do so. This investment hopes to bring the benefits of:

- Collecting the right data efficiently

- Use data more effectively and become more data-driven to identify and prevent harm

- Review and analyse unstructured data from various sources more efficiently

More Assertive:

FCA indicated that it would test the limits of its powers. For example, reference was made to the number of criminal proceedings launched by the FCA highlighting that it is not afraid to take action where deemed necessary.

A clear ‘Use it or Lose it’ message was sent to firms. The FCA will remove permissions from those firms who are authorised, but not conducting regulated activities. The rationale being to prevent firms using the FCA authorisation as a means of looking more trustworthy. It also indicated its intention to continue its consumer alerts to prevent harm.

On this theme, there will be a more robust gateway for authorisations with the intention of keeping the ‘unfit’ out of the FS sector. FCA is recruiting 100 additional staff into its authorisation team to support its efforts. The authorisation process will be more robust and greater scrutiny of firms’ financial and business models will take place.

More Adaptive:

FCA wishes to better reflect the UK. This is reflected in the expansion of its Edinburgh office, consideration of a Leeds presence and the opening of additional offices in Belfast and Cardiff to take advantage of local skills. It aims to promote higher standards of diversity and inclusion.

In line with its work on operational resilience, FCA wants firms to be prepared for a world that is constantly being disrupted. Regulated firms require a stable platform to deal with disruptions and whilst embracing technology, being mindful that criminals are entrepreneurs too, seeking opportunities to disrupt business. Greater collaboration is needed to build resilience.

To support its overarching strategies, the FCA is piloting a set of metrics by which to measure success. The metrics include:

- Reduce FSCS levy over a multiyear timeframe, as well as the value and volume of claims

- Refusal, rejection and withdrawal rates for authorisations

- Reduce complaints about newly authorised firms

- Removal of permissions

- Reduction in number of calls to the FCA

- Increase ScamSmart campaigns

- Market cleanliness measures

This will enable greater transparency and accountability regarding regulatory activities.

What can we expect?

Both the FCA and PRA acknowledge the need to develop their respective organisations to support an evolving FS sector. There is a clear direction of travel towards greater transparency and accountability with stated metrics and oversight committees.

They have shared visions of supporting sustainable finance and encouraging diversity within the FS sector. There is also greater coordination of efforts between the regulators and perhaps more importantly, their desire to embrace technology. Like the EU, we’re seeing the UK supervisors seeking to become more efficient in their data collection to improve their oversight responsibilities.

How can we help?

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC. Click on the links below or contact us for further information.

Tel: 020 3965 2166 or hello@ruleguard.com

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)