%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

The Government wishes to ensure we have a regime that demonstrates:

- high standards to build confidence and trust in the market

- supports the economy, innovation, entrepreneurship and wealth creation across society

- open and competitive markets to strengthen the UK’s position as a FS global hub

- fair and proportionate standards focused on outcomes rather than prescriptive rules to reduce friction and costs

What are the rules?

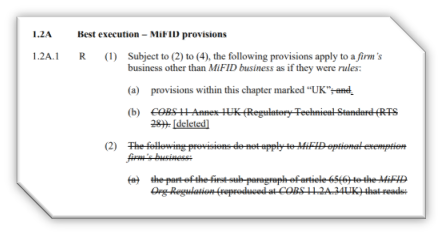

From 1 December 2021, MiFID investment firms are no longer required to prepare RTS 27 and RTS 28 reports (COBS 11.2A).

Figure 1: PS21/20

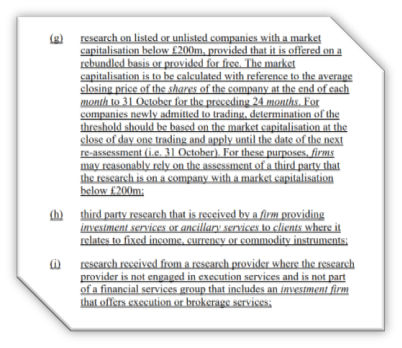

- the research is about SME issuers below a market capitalisation of £200m or

- third party research is on fixed income currencies and commodities (FICC) instruments or

- research is provided by research providers who do not provide execution services and are not part of a group that includes a firm offering execution services and openly available research.

Figure 2: PS21/20: COBS 2.3A.19R

MiFID II introduced requirements to set separate charges for transactions and research, referred to as unbundling. The aim was to increase transparency regarding fees charged to investors for research and execution services. The regulations required firms receiving research to either purchase research themselves from their own monies or agree a separate research charge with their clients.

As part of the regulatory aim to ensure proportionality, the changes to research rules aim to differentiate between different parts of the market. For example, MiFID II requirements apply to research regardless of the market capitalisation and size of the firm. SME research is less likely to give rise to the harms as the transactions levels are generally lower, therefore there are lower incentives offered.

Similarly, Independent Research Providers (IRPs) only account for a small proportion of the overall research market, including for SME research. IRPs are an alternative source of research to that provided by investment firms. If IRPs are solely providing research, their research does not raise the same conflicts that can arise from investment firms providing both research and execution services.

The rule changes should encourage take-up of independent research and encourage competition.

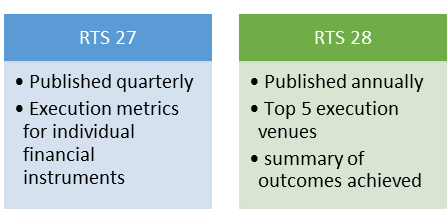

Best Execution Reports:

MiFID II also introduced reporting requirements for execution venues (RTS 27) and firms executing & transmitting client orders were required to publish information on execution quality and order routing (RTS 28). The aim was to improve investor protection and transparency in how firms execute client orders. The reports should have helped market participants to make comparisons and enable better execution.

In reality, the production of the reports caused confusion and created challenges for firms, both large and small. To top it all, the end users indicated that they didn’t want or read them.

Figure 3: RTS 27 and RTS 28 Content

Positive Changes:

For those firms that are able to take advantage of the research exemption criteria, these are positive changes. Where firms have limited resources and time constraints, these changes mean that time and energy can be diverted to more valuable tasks.

Compliance teams can focus on monitoring and ensuring the firms continue to meet the exemption criteria.

Firms can benefit from better availability of research material, ultimately leading to better outcomes for clients.

What actions should firms take?

MiFID investment firms obtaining investment research will have policies and procedures relating to how research is obtained as well as how conflicts are managed. It’s now time to:

- review those arrangements

- check that the subscriptions register is up-to-date

- review the contracts to understand the arrangements

- determine whether or not the exemptions apply

Where an exemption applies, determine what actions are necessary:

- how do you communicate to and make staff aware of changes?

- do you need to update your research contracts and method of payment?

- what are the impacts? Does it impact any third party arrangements?

- do you need to update any disclosure documents or internal procedures?

- what communications should you need to send to your clients?

The above requires coordination and confirmation that all appropriate steps have been taken. An audit trail is useful to demonstrate robust governance as well as to help your control functions identify any weaknesses in the processes. Firms should also ensure ongoing monitoring to confirm that they remain in within the scope of the exemptions.

Ruleguard checklists allow you to create sets of tasks that can be organised into lists and scheduled with a sophisticated frequency management system. Whether tasks are relevant every day, or run to weekly, monthly, or less frequent schedules, they can be configured within Ruleguard to operate exactly when you need.

When tasks are due, they appear in a dedicated Inbox view within Ruleguard, and the system can also issue email alerts to relevant individuals as needed. Completing tasks on Ruleguard is fast and straightforward, meaning that the workflow is unobtrusive and adds only a minimal step to day-to-day compliance activities.

In return, Ruleguard provides rich reporting and review features about every checklist being managed, giving you detailed insights at the touch of a button. Audit preparation is simplified with full logs of task results being available and exportable outside of Ruleguard. And individuals at every level of the compliance process have real-time access to the latest status about every item.

Please contact us for further information on Tel: 020 3965 2166 or hello@ruleguard.com

Webinars:

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

See our blog page for further articles or contact us via: hello@ruleguard.com

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)