%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

The regulators believe that the key to delivering this strategy is that the financial services sector needs to build trust through greater transparency. This is a recurring theme noted in the FCA’s business plan and UK consultations including the proposed audit and corporate governance reforms.

The speech coincided with FCA’s publication of DP21/4 Sustainable Disclosure Requirements and Investment Labels. The discussion paper is a precursor to further consultation due in 2022. FCA’s CEO indicated a dual approach to the proposed disclosures:

ESG challenges:

Greenwashing refers to misleading or unsubstantiated claims about environmental performance. Schroders’s Sustainability Institutional Investor Study 2021 indicates that 60% of ESG investors raised this as a challenge. Plans are afoot to incorporate international standards by taking into consideration the IOSCO recommendations. The IOSCO’s view is that standards will counteract the negative impact of greenwashing.

What does the UK wish to achieve?

FCA has indicated its target outcomes are:

- high-quality climate- and wider sustainability-related disclosures to support accurate market pricing, helping consumers choose sustainable investments and drive fair value

- trust and consumer protection from mis-leading marketing and disclosure around ESG-related products

- that regulated firms have appropriate governance arrangements for more complete and careful consideration of material ESG risks and opportunities

- active investor stewardship that positively influences companies’ sustainability strategies, supporting a market-led transition to a more sustainable future

- integrity in the market for ESG-labelled securities, supported by the growth of effective service providers – including providers of ESG data, ratings, assurance and verification services

- innovation in sustainable finance, making use of technology to bring about change and overcome industry-wide challenges

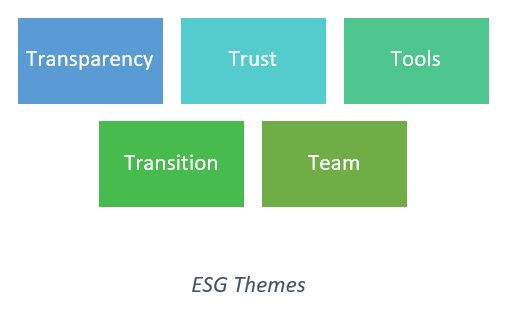

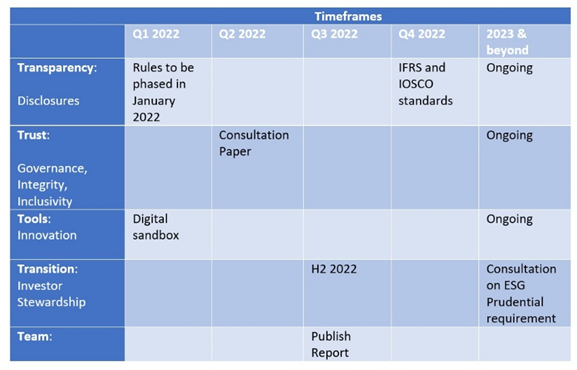

The FCA suggests 5 building blocks to help them achieve their ESG strategy.

- Transparency: Promoting good and consistent disclosures along the investment chain

- Trust: Ensuring that the market delivers sustainable finance instruments and products that genuinely meet investors’ sustainability preferences – and are seen to do so.

- Tools: Government, regulators and industry working collaboratively to share experience, develop consistent guidance and tools and provide mutual support as we confront the challenges of climate change.

- Transition: Developing FCA’s role in supporting a market-led transition to a more sustainable future.

- Team: Embedding climate and other sustainability considerations within the way the FCA functions as an organisation.

Timeframes:

The regulatory road map has been drafted. This includes the publication of various standards and consultations over the next 12 months and beyond. It begins by phasing in the disclosure rules during 2022.

Embedding ESG:

UK supervisors expect all regulated firms to meet these standards. Firms failing to meet the standards are to be held accountable.

It’s vital that boards determine and communicate their ESG policies to staff. Like TCF (Treating Customer Fairly), ESG policies need to be living documents that change along with the business. The ESG strategy needs to be embedded in the firms’ objectives and culture. To support this, firms require strong governance infrastructure:

- Clearly defined ESG policy

- Supported by the business objectives

- Implemented by the conduct within a business

- Evidenced by an audit trail of attestations

- Workflows with supporting evidence

- Reporting that demonstrates compliance as well as highlighting trends or areas to watch

How Ruleguard can help you:

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Ruleguard checklists allow firms to create sets of tasks within the application. https://www.ruleguard.com/tasks-checklists

Tasks can be organised into lists and scheduled with a sophisticated frequency management system. Whether tasks are relevant every day or run to weekly, monthly, or less frequent schedules, they can be configured within Ruleguard to operate exactly as you wish.

Tasks can be organised into tiers with configurable dependencies, letting you set up reviews and checkpoints at every level of the list. For example, four-eye checks can be made mandatory before tasks can be signed off.

Get in touch with the Ruleguard team to learn more on 020 3965 2166 or hello@ruleguard.com.

Ruleguard hosts monthly events. To register your interest or view our past events please click here.

White Paper:

Request a complimentary copy of our White Paper on Operational Resilience click here.

Further resources:

See our blog page for further articles or contact us via: hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help:

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)