%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

This statement encapsulates the importance of the annual reports and their audit, not just in verifying the financial status of individual firms, but by the impact upon the wider UK infrastructure. We’re all too aware of high-profile firms going bust without any warning, and the scrutiny that placed upon auditors.

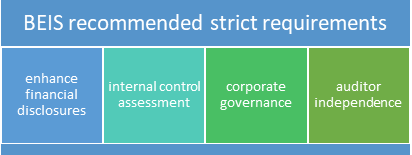

Various company failures prompted independent reviews and recommendations, culminating in the UK Government issuing its proposals for audit reform. The Government’s Consultation and Response highlighted the need for sweeping changes including:

- directors held to account for significant failures in their corporate reporting and audit-related duties

- auditors required to follow high standards under a new regulator, Audit, Reporting and Governance Authority (ARGA), and

- professional bodies subject to better oversight by ARGA & required to take action on their own behalf

The Government’s call for strict requirements means changes to the audit infrastructure. It’s no surprise that the Financial Reporting Council (FRC) has published its proposed strategy.

FRC’s Approach:

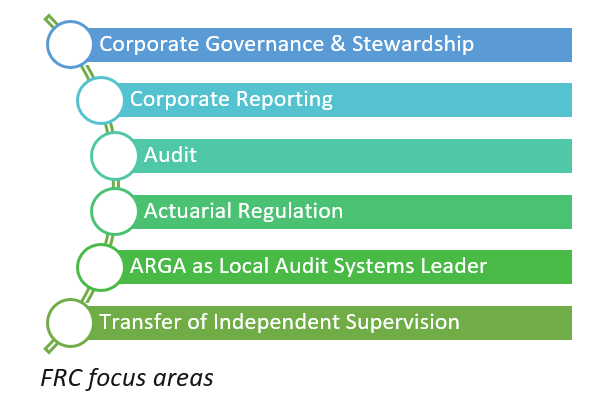

The FRC’s Position Paper outlines its proposed approach to address the Government’s audit requirements. The paper should provide clarity to all stakeholders ahead of the impending legislation.

The FRC will be taking specific action in the following areas:

- Revising its existing Codes, Standards and Guidance to reflect the reforms

- Developing new standards to allow voluntary adoption ahead of legislation, such as the Minimum Standards for Audit Committees

- Setting expectations to drive behavioural changes ahead of statutory powers

- Developing guidance to address issues set out in the Government Response relating to how ARGA is to operate, and

- Setting high-level expectations around the future supervision and monitoring activities based on the revised standards to be drafted

UK Corporate Governance Code:

Let’s consider the proposed changes to the UK Corporate Governance Code. The Code has been in place for a good number of years and is regularly updated. It has been so successful that it has been held as a benchmark for similar standards across the globe.

- Providing additional support in the existing Code Provisions, where reporting is currently weaker, taking account of issues raised in FRC’s research and reports

- Revising those parts of the Code which deal with the need for a framework of prudent and effective controls to provide a stronger basis for reporting on and evidencing the effectiveness of internal control around the year end reporting process

- Revising the wider responsibilities of the Board and Audit Committee to reflect the Sustainability and ESG reporting and, where required, appropriate assurance in accordance with a company’s audit and assurance policy

- Board to consider how audit tendering undertaken by the company takes account of the need to expand market diversity, and

- Updating the Code to ensure that it covers proposed changes to legal and regulatory requirements as set out in the Government Response, including strengthening reporting on malus and clawback arrangements.

Additionally, the FRC plans to update guidance relating to:

- Guidance on Audit Committees and Guidance on Board Effectiveness (to support with the revised Code and reforms highlighted in the Government Response)

- Guidance on Risk Management, Internal Control and Related Financial and Business Reporting specifically to take account of changes to Principles and Provisions on internal control and its effectiveness

What does this mean for companies?

In practice, the revised Codes, Standards and Guidance indicate that companies will need to collate more data and evidence to substantiate their reporting and accounts. It means greater accountability at the top, both board and individual accountability.

It also means reviewing internal policies, procedures and data collection to ensure companies are meeting their obligations.

Information provided to auditors will come under greater scrutiny and boards will need to have assurance that data provided is a true reflection of a company’s performance.

In short, more reliable data is required, improved assurance provided to boards and greater sharing of data between various parties. Don't forget those parties include key stakeholders; not just shareholders, but the general public too.

The ultimate aim of the audit reforms is to gain the trust of stakeholders and to ensure the financial stability of the UK economy.

There is more to the audit reforms than revising the Codes. Ruleguard will publish more on this subject shortly. Stay tuned for more on this subject!

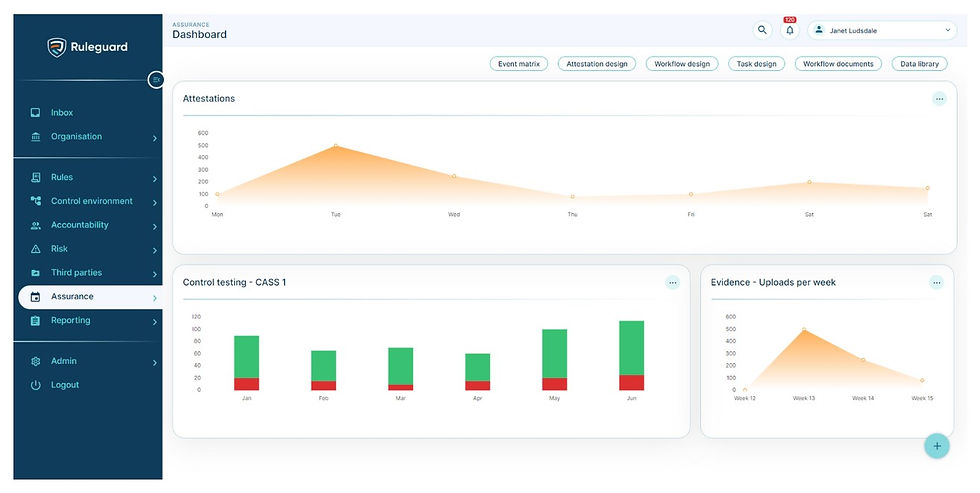

Ruleguard enables board assurance:

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

The solution is made up of several core modules which can be deployed to provide automation and reduction of compliance risk at different points in the compliance journey. Together, these work to make Ruleguard a holistic platform which delivers end-to-end benefits at every level of a regulated financial services firm.

Traditional compliance documentation and monitoring is manual and happens only periodically. With Ruleguard, key areas of compliance can be automated and put under direct review by appropriate individuals across the business. This means that monitoring can be embedded directly into business-as-usual processes, vastly simplifying the process and significantly reducing the overhead required to carry it out.

Ruleguard provides rich reporting and review features about every task being managed, giving you detailed insights at the touch of a button. Audit preparation is simplified with full logs of task results being available and exportable outside of Ruleguard.

And individuals at every level of the compliance process have real-time access to the latest status about every item.

Ruleguard has the potential to revolutionise what your firm understands by compliance monitoring and deliver best-in-class governance, oversight and management of compliance risk.

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)