%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

Author: Priscilla Gaudoin - Head of Risk & Compliance. First published in March 2023

Topics: Conflicts of Interest, Evidence, Consumer Duty, Compliance, Risk Management

Regions and Regulators: UK, FCA

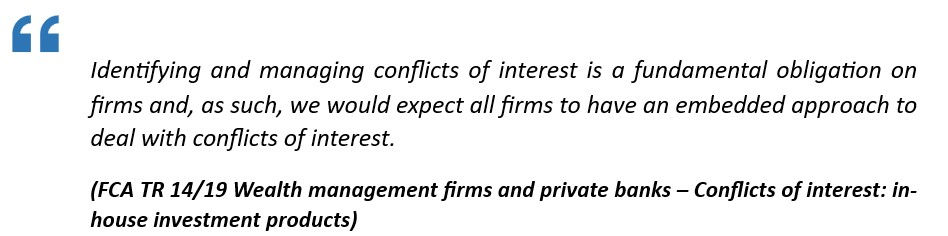

The FCA undertook a thematic review in 2014 that focused on the wealth management and private banks sector. Whilst there was positive feedback around heightened awareness of conflicts of interest amongst the C-suite, there were also a few areas for improvement, including the need for:

- Better articulation of how in-house investment products (IHPs) related to the firm’s business model and strategy, and aligned with customers’ interests.

- Improved monitoring of the allocation of IHPs within customer portfolios to help demonstrate effective management of conflicts.

- Improved communications to the customers about the firm’s services and how IHPs might feature in customer portfolios.

Regulatory focus areas:

It’s about assessing the business strategy and objectives; how well do they align with acting in the client’s best interests?

Looking at the governance structure within a firm, how is information shared? What data is reviewed by the board to enable them to gain assurance that conflicts are being managed?

What does this mean for firms?

Under SYSC 10, firms must take all reasonable steps to identify conflicts. The onus is on firms to identify all actual and potential conflicts of interest affecting the firm, followed by assessment of the impact of those conflicts and then the implementation of appropriate controls to avoid adverse effects upon clients or the firm.

Regulatory feedback indicates that many firms have a process in place for identifying conflicts, but a lack of key metrics to monitor conflicts leads to weak governance structures.

Why should firms take notice?

Despite the requirement for firms to identify and manage their conflicts, for some firms, this appears to be considered a low-risk area. Consequently, firms fail to go that extra step to demonstrate how they’re managing conflict, and monitoring the status via regular reporting. How many boards ask their members to disclose their conflicts prior to a decision being made? It is a standing agenda item?

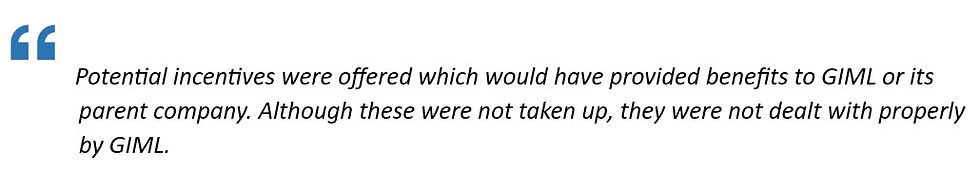

In March 2022, the FCA fined GAM International Management Ltd (GIML) the sum of £9.1 million, as well as its former investment director. The director was personally fined £22,437 representing the total value of gifts and hospitality that he failed to record in a timely manner. The company was fined for not taking appropriate action regarding potential incentives offered. FCA’s notice outlines that whilst there was no evidence to suggest that the director had been influenced by these incentives, nonetheless, the failure to make timely disclosures and the firm’s failure to prevent such conflicts means that the firm failed in its duty to act in the investors’ best interest.

Firms should ensure alignment throughout their business, from the board setting its strategy to the frontline staff helping customers. Greater emphasis is needed upon recordkeeping & evidence to support the decisions and actions taken, to demonstrate obligations have been met.

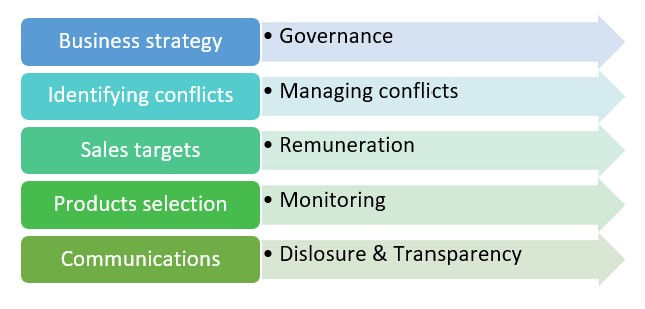

FCA's examples of good practice

Firms should review their conflicts management processes to identify potential weaknesses and take appropriate action. This is particularly important right now, given the Consumer Duty deadline of July 2023. Firms should be able to demonstrate how products and services meet the customers’ interests, but also how those firms are preventing harm to the consumer.

Additionally, firms should not forget to review their management information to identify key metrics that will help the board monitor trends and track improvements in conflicts management.

Finally, firms should consider how this information is collated and feeds into other processes such as SMCR processes and risk management frameworks. An holistic approach to managing conflicts should be adopted that includes assessment of wider impacts upon business.

Ruleguard helps firms to demonstrate and evidence compliance, by using its comprehensive rules-mapping, risk and control tools, automated reporting features and powerful dashboards. Tracking activities through to completion, monitoring adherence to the requirements and providing evidence of compliance is complex and time consuming. Ruleguard can help compliance and risk to easily identify potential issues via personal dashboards and alerts to encourage a proactive approach to compliance. Find out more about our Compliance Management solutions.

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Mitigate Risk, Build Trust

Stay on top of personal account dealing and outside business interests with Ruleguard’s Conflicts of Interest solution. Automate disclosures, streamline approvals, and gain real-time oversight, ensuring your firm stays compliant and trusted.

Feel free to explore some relevant content below:

Blog: How to demonstrate good governance

Blog: Prevent bribery occurring on your watch

Navigate conflicts with ease and enjoy crystal-clear compliance

Foster a culture of policy comprehension, transparent disclosure, timely resolution, and bulletproof audit trails with Ruleguard’s Conflicts of Interest software.

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)