%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

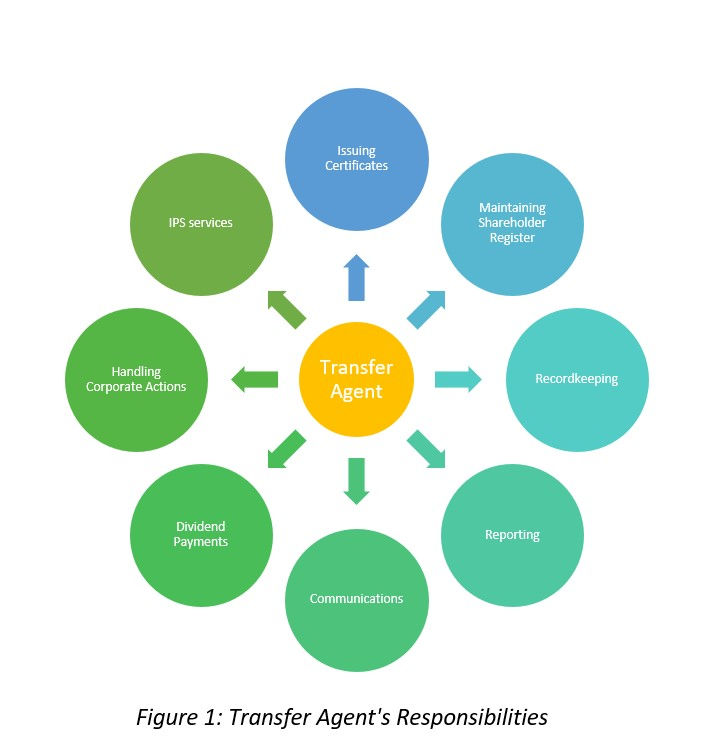

Transfer agents play an important role in financial services.

- registers of shareholders for issuers

- recordkeeping, reporting and communications

- dividend payments

- corporate actions

- IPO services

Depositary banks’ responsibilities:

Under the various fund regimes, depositary banks are liable not just to the funds, but their clients and the underlying investors. This liability creates the need for depositary banks to undertake monitoring and gather data from various sources.

The challenge means large amounts of data need to be collected and processed. How can firms manage and share such large data files without breaching data security requirements?

Understanding the risks:

One of the aims of introducing the AIFMD and UCITS V regimes was to improve transparency. Consequently, TAs are under greater scrutiny.

Funds are required to provide investors with information, seek consent, where applicable, and maintain information relating to the investors’ assets. These duties may be outsourced to TAs to maintain accurate information.

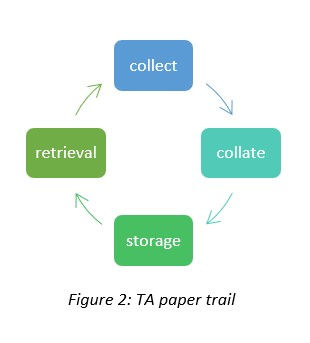

In this way, TAs handle a vast amount of paperwork. Take a moment to consider the following tasks:

- completing AML checks

- regulatory reporting

- document collation and dissemination

- error reconciliations

- corporate action processing

Now, consider that those same TAs may be undertaking the above tasks for a variety of funds. Imagine the volume of data being processed. It’s vital that they ensure security of data throughout the lifecycle of their duties. This means understanding what data is held, where is it held, how it is stored and finally the ability to retrieve that information.

As the funds are held responsible, its vital that they engage competent TAs. This means that funds will be conducting, not just initial due diligence on TAs, but ongoing monitoring. The funds need to gain assurance that the TAs are fulfilling duties as well as ensuring the security and integrity of that data.

TAs need to respond quickly to requests for information. Failure to provide information in a timely manner could prompt an alert to depositary banks. Where a depositary is unable to obtain a clear picture of the TA, it may advise against investing in a fund.

- How do you ensure the accuracy of records maintained by the TA?

- How easily can you obtain the data that you need to verify compliance with CASS requirements?

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance, including CASS compliance. It offers a range of tools to help firms fulfill their obligations across the UK, Europe, and APAC regions.

Contact the Ruleguard team to learn more on 020 3965 2166 or hello@ruleguard.com

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com

Webinars:

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

See our blog page for further articles or contact us via: hello@ruleguard.com

Contact the author

Head of Client Regulation | Ruleguard