%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

FMIs include Central Counterparties (“CCPs”), Central Securities Depositories (“CSDs”) and payment systems recognised under the Banking Act 2009 (“recognised payment systems”) as well as specified service providers to these recognised payment systems.

Why should FMIs be subject to SM&CR?

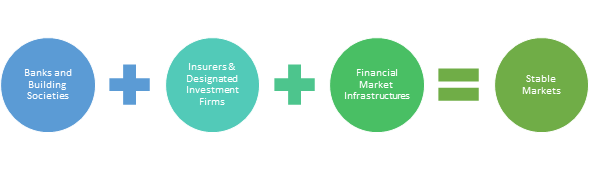

This extension of the SM&CR reinforces HMT’s aim to ensure a stable financial system as outlined in their Phase II of the Financial Services Framework Review. FMIs are seen as a critical link in the financial services sector and enable the financial markets to operate efficiently.

Their importance is highlighted by the significant harm caused if a severe failure occurred. As a reminder, think back to the fines imposed upon Raphaels Bank by the PRA and FCA in 2019. Failures at a card processor crystallised on 24 December 2015 and lasted for 8 hours. During one of the busiest times of the year, customers were prevented from making transactions both online and at point of sale.

The concern is that current regulation supports oversight of the FMI entities. The focus now is upon individual accountability. Inclusion within the SM&CR provides consistency in regulatory approach resulting in the regulator’s ability to pursue individuals as well as the FMI. The end goal is to encourage a culture of accountability whereby individuals take ownership and can provide assurance to their boards that risks are being managed appropriately.

As you might expect the proposals are not unlike those for banks and insurers except the Bank of England (BoE) is set to provide supervisory oversight. New powers for the BoE are required to enable oversight of the regime, setting rules and disciplinary powers. Timing of the roll out depends on updated legislation being passed.

The regime will enable the BoE to assess fitness of senior managers as well as to hold individuals accountable as defined by their individual responsibilities.

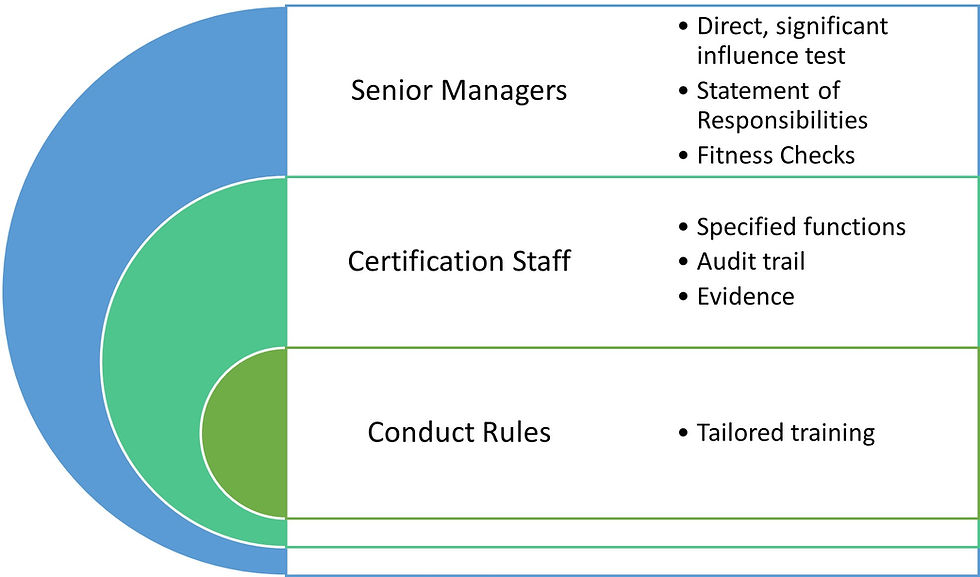

Senior Managers Regime:

Firms will need to identify senior managers, which is likely to include: CEO and Chair of the Board; regional or global business heads; chief operating officer.

- Identification will be based on those roles involving risk of serious impact on the FMI or for business in the UK. This is referred to as the “direct, significant influence test”, which could also capture individuals located overseas

- Preparation of Statement of Responsibilities are required for the application and fitness checks performed each year

Certified Regime:

FMIs need to assess and certify staff performing ‘specified functions’. Aside from implementing a process that works, firms will also need an audit trail and supporting evidence. Firms need to consider:

- How to identify trends in staff behaviours and early warning indicators

- What management information is needed to support good governance of the process

Conduct Rules

Employees need to be trained to understand how the following rules apply in their roles:

- You must act with integrity

- You must act with due skill, care and diligence

- You must be open and cooperative with the FCA, the PRA and other regulators

Whilst senior manager training should be tailored to include the following responsibilities:

- You must take reasonable steps to ensure that the business of the firm for which you are responsible is controlled effectively

- You must take reasonable steps to ensure that the business of the firm for which you are responsible complies with the relevant requirements and standards of the regulatory system.

- You must take reasonable steps to ensure that any delegation of your responsibilities is to an appropriate person and that you oversee the discharge of the delegated responsibility effectively.

- You must disclose appropriately any information of which the FCA or PRA would reasonably expect notice.

Whilst the consultation closes in October, updated legislation then needs to be adopted. Firms can take steps now by reviewing their governance structure and looking at which individuals are likely to fall into which category: senior managers or certified staff. Most organisations already complete some due diligence on new starters, but perhaps that information needs to be refreshed more frequently? Here firms could review their HR processes and identify any opportunities to improve processes. An audit trail of the key changes and documented processes should be maintained to enable senior management oversight.

Please contact us for further information on:

Tel: 020 3965 2166 or hello@ruleguard.com

Further resources:

See our blog page for further articles or join our mailing list.

Visit our website to find out more about how Ruleguard can help:

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)