%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

The UK insurance sector is the 4th largest in the world. According to the Association of British Insurers, its members manage approx. £1.7 trillion investments and pay over £16 billion in taxes to the Government. The insurance sector supports communities across the UK by enabling trade, risk-taking, investment and innovation.

The failure of an insurance company can cause enormous harm. So it’s not surprising that the global pandemic caused the Financial Conduct Authority (FCA) to prompt insurers to focus attention on managing and mitigating any impact upon their operations.

Senior Manager Responsibility:

Senior management within insurance firms should be confident that they can demonstrate:

- robust systems and controls to continue services “in a stressed situation”

- staff throughout the company are acting in the best interests of its customers

- its communications are clear, fair and not misleading

All the above support the supervisory focus of protecting consumers, especially when individuals might be vulnerable.

How might failure arise?

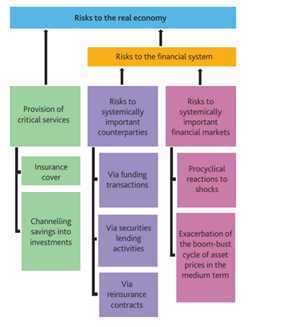

Going back a few years to 2015, the Bank of England’s Bulletin highlighted the potential impact upon the UK economy from insurers.

Source: Bank of England 2015 Bulletin – Potential transmission channels of risk from insurers

Insolvency Law:

The UK’s insolvency law aims to protect and retain the value in a firm and ensure a fair distribution of assets to the firm’s creditors (i.e. anyone to whom the firm owes a debt). In May 2021, the UK government outlined proposals in a new consultation to enable the UK authorities to:

- Promoting continuity of cover by earlier regulatory intervention to encourage a solvent run-off

- Protecting of policyholders by safeguarding them in certain scenarios

- Reducing costs to industry by reducing the value reduction of a distressed insurer. The knock-on effect would reduce the FSCS compensation funded by industry

- Maintaining public confidence

The intention is to enable better management of insurers in distress. This means the regulators would intervene earlier to maintain solvency to allow run-off. The insurer would be closed to new business, but have sufficient funds to settle any claims. Rules would be amended to safeguard policyholders under certain circumstances.

Risk of Protection Gaps:

The protection offered by insurance and the stable supply of protection is an essential service to both consumers and businesses. Protection gaps can slow investment resulting in impaired recovery. In 2021, insurers need to focus on longer-term strategies. This means looking at investment, climate change impacts and operational resilience.

Regulatory Focus:

The type of insurance products and services sold have changed rapidly. With rapid advancements in technology, supervisors have focused on insurers’ reliance upon technology.

Insurers must have plans in place to enable them to continue business, no matter what the cause of the disruption. This is not merely a question of identifying and assessing risks, insurers must assume that risks do and will crystallise. Insurers must ensure that they take appropriate steps to map processes and assess failure points in a service. This will enable boards to decide where and what investment decisions need to be made.

Insurers need to have the above steps completed by 31 March 2022. Following this, a transitional period ending 31 March 2025 allows them additional time to:

- perform mapping and testing so that they can remain within impact tolerances for each important business service

- make the necessary investments to enable firms to operate consistently within their impact tolerance

The first deadline is less than 6 months away. Given the role that insurers play in our economy, they can't afford to get it wrong.

How Ruleguard can help you:

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Ruleguard allows firms to organise planning for extreme but plausible scenarios, model impact tolerances and identify investment gaps.

It also helps firms to:

- define service levels and tolerance thresholds for each service to define how much impact on customers and the market is acceptable in extreme but plausible scenarios

- vary the resource parameters using our intuitive interface and see how these changes impact your service thresholds in the model

- easily identify gaps for investment and automatically create a resilience self-assessment document for board review

The scale of operational resilience compliance can seem daunting, but with Ruleguard's experience and technical design skills, we’ll help you quickly have it under control. https://www.ruleguard.com/operational-resilience

Get in touch with the Ruleguard team to learn more on 020 3965 2166 or hello@ruleguard.com

Ruleguard hosts monthly webinars, to register your interest or view past events please click here.

Don't miss our White Paper! To request a copy, click here:

See our blog page for further articles or join our mailing list to keep updated.

Visit our website to find out more about how Ruleguard can help:

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)