%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

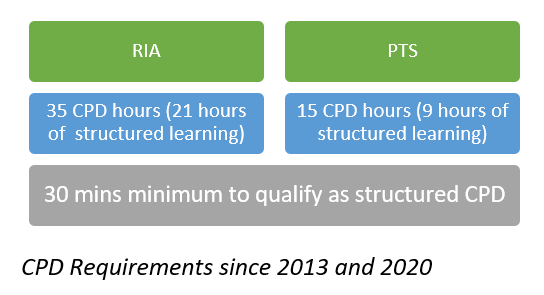

RDR introduced CPD requirements in 2013. It required Retail Investment Advisers (RIAs) to obtain a minimum level 4 qualification and complete 35 hours of CPD (of which 21 hours had to be structured). The objective was to raise the competence bar for these high risk roles.

In addition, individuals must hold a Statement of Professional Standings (SPS) from an FCA accredited body (eg professional bodies like: CII, CISI, CFA etc). This provides a degree of independent assessment. The SPS is issued annually and confirms an individual has the required qualification. It also confirms that the individual continues to meet the minimum competence obligations, including required CPD hours and the APER or COCON obligations.

What qualifies as CPD?

Each accredited (or professional) body issues guidance to firms and their members regarding structured content and offers their own CPD for members to complete. This may take the form of internal briefing sessions or external training courses, seminars, podcasts etc.

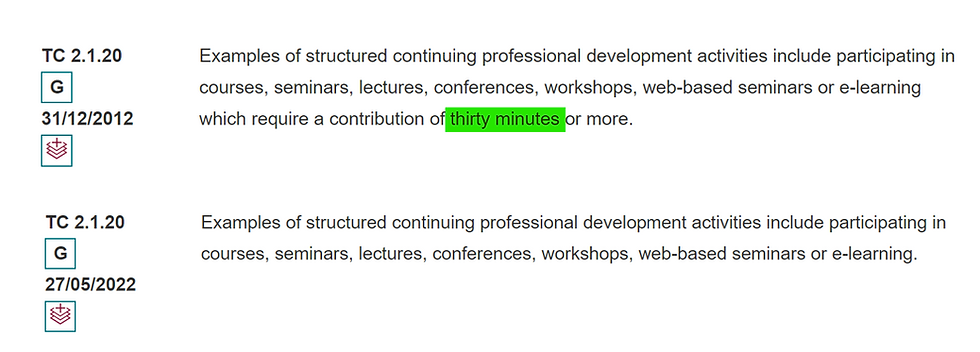

However, for the training to qualify as structured CPD, a minimum 30 minute duration has been in place since 2013.

In April 2022, the FCA proposed amendments to the requirements set out in the Training and Competence sourcebook (TC 2.1.20G/TC2.1.23AR91) and TC 2.1.23AR(2)(a).

Following a 5-week consultation period, the proposals were implemented in May 2022 with the TC sourcebook updated:

So how does this affect HR and Compliance?

This means firms now need to consider whether to remove the 30 minute requirement from their internal policies and procedures. How does a firm demonstrate that structured learning has been of benefit if the activity only lasts 10 minutes long? What if an adviser only participates in a briefing session for 5 minutes and leaves to take a client call?

I guess this is where testing comes into play to provide evidence of learning. Some professional bodies produce online material which requires individuals to watch the full session before completing (& passing) a test to prove their understanding. Perhaps we’ll see more innovation in this area.

How Ruleguard can help you:

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Ruleguard for SM&CR is an end-to-end technology solution designed to help firms reduce the cost and regulatory risk arising from compliance with the Senior Managers and Certification Regime.

Using Ruleguard, firms can document every employee within the SM&CR population and organise all of the information needed to comply with the rules.

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

To register your interest or learn more, please click here.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)