%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

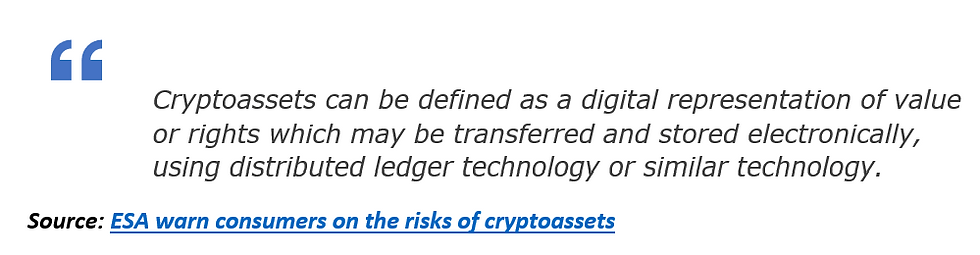

What are cryptoassets?

This appears to be a common question which receives various responses. The European Supervisory Authorities (ESA) provides the following description:

- Cryptocurrencies

- Utility tokens

- Stablecoins

- Central Bank Digital Currencies (CBDC)

- Security tokens

- Non-Fungible tokens

From list above, we can begin to see why the regulators are so concerned. Before individuals start to purchase these assets, it’s important to understand what they are, how they work and the associated risks. In some countries such as the US, the regulators debate whether cryptoassets are securities or credit default swaps, if this is causing debate within the regulators, then this leaves plenty of room for confusion amongst retail clients.

What are the issues?

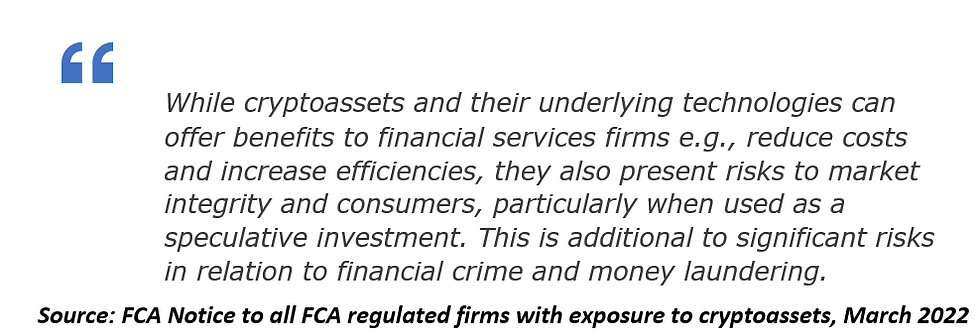

Regulators highlight that these are high risk investments, consequently, consumers need to understand the underlying risks. Every week, another regulator seems to issue a warning to the public. This is due to the increased interest in cryptoassets and the aggressive promotion of these assets and related products to the public. The ESA issued a joint warning to consumers. The message is that:

- Possibility of losing all their invested monies from extreme price movements

- Awareness of misleading advertisements

- Wary of promised fast or high returns

In addition to the above risks, many people don’t realise that these assets are not regulated. Consequently, they fall outside any protection available under compensation schemes such as the FSCS in the UK.

In the UK, cryptoassets fall within the scope of the Money Laundering Regulations. It means that the firms are registered with the FCA to prevent the risk of financial crime only.

What action should firms take?

Firms need to assess the risks posed by cryptoassets to themselves and their clients. This means treating them in the same manner as other regulated activities. The interest in cryptoassets is increasing with central banks looking at new forms of digital money. Given this increased awareness, firms trading in cryptoassets should consider how these assets might impact their balance sheet.

The PRA’s recent letter to industry placed emphasis was placed upon firms to measure and mitigate risks posed by crypto activities. Firms are urged to:

- Implement strong risk controls

- Conduct operational risk assessments

- Review new product approval processes

as well as ensuring appropriate regulatory capital levels and ongoing monitoring.

Ruleguard is here to assist:

With Ruleguard, key areas of compliance can be automated and put under direct review by appropriate individuals across the business. This means that monitoring can be embedded directly into business-as-usual processes, vastly simplifying the process and significantly reducing the overhead required to carry it out.

Ruleguard has the potential to revolutionise what your firm understands by compliance monitoring and deliver best-in-class governance, oversight and management of compliance risk. Online workflows make it simple to complete tasks, and Ruleguard’s file repository features allow you to store and keep an audit trail of relevant documents.

Detailed MI and reporting features give you complete oversight of the breach process, and the rich relationship mapping created through Ruleguard provides the ability to report on breaches organised however you need.

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com

Ruleguard hosts regular events.

To register your interest or learn more, please click here.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via: hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help:

Contact the author

Head of Client Regulation| Ruleguard