Author: Priscilla Gaudoin - Head of Risk & Compliance - first published in August 2023

Topics: Accountability, Regulatory Strategy

Regions and Regulators: UK, FCA, PRA

%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png) SM&CR Under Review: What You Need to Know

SM&CR Under Review: What You Need to Know

This isn’t the first review of the regime. Since the regime was first implemented in 2016, there have been various reviews undertaken by the regulators as well as industry bodies. We now have a joint review taking place which emphasises the importance of this regime to the UK, and perhaps more wide-scale reform.

Challenges of SM&CR:

Those earlier reviews highlighted that there is broad support for the regime, but questions are asked about its effectiveness, as well as its impact upon the UK’s ability to attract investment into the UK and bolster its status as key global financial services hub.

Firms have indicated that the regime has encouraged greater understanding of internal structures and responsibilities. It has also improved management and outcomes for both businesses and their customers.

The government is now keen to explore how the regime can continue to meet its objectives without causing major upheaval to the industry. At the same time, it wants the UK to remain attractive to international investment to drive economic growth. The message from the PRA and FCA in their discussion paper is similar.

According to some firms, whilst the regime isn’t necessarily a problem, the practicalities of the regime can have an adverse effect on business.

What changes are needed?

We gather from the previous feedback that most firms are largely supportive of the regime and have seen the benefits it offers both them and their customers. However, like all new processes, it’s always a good to pause and review the situation to see what is working and what might be improved for the best. With one eye on effectiveness of the regime and another on the wider UK economy, what’s best for the UK?

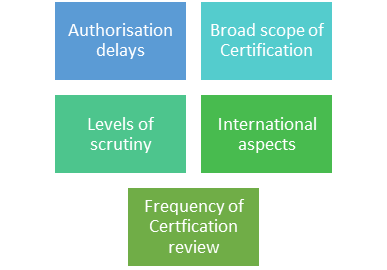

Industry’s concerns about the regime tend to focus on the following areas:

- Delays by FCA in approving senior managers

- Breadth of coverage for the certification regime

- Levels of scrutiny for different firms

- Interaction with similar international regimes

- Frequency of certification review

The above have been addressed to some degree.

Over the last 12-18 months, we’ve seen the regulator on a major recruitment drive increasing its headcount to address issues in its authorisation teams, etc. Applicability of the regime and its impact upon firms will differ. That’s part of the proportionality of the regime. However, it can raise administrative issues for smaller firms who need to demonstrate compliance too.

Wider concerns seem to centre around the certification regime. Those firms that operate globally may need to comply with similar accountability regimes in various jurisdictions. This poses challenges to firms as UK requirements may be more stringent than other regimes, and firms may find UK executives responsible for activities usually undertaken by overseas executives. It also poses the additional challenge or risk of attracting overseas talent to the UK. Due to the broad applicability of the certification regime, it does come with a degree of administrative burden. Maintaining data and records can be labour intensive and time consuming, especially when you consider the requirement to maintain the FCA directory of certified and assessed persons.

Experience uncomplicated accountability

Relevant Resources & Insights

- Accountability: Satisfying global standards

- AI and Regulations Podcast | Ruleguard

- AI in Finance: Navigating the Regulatory Landscape

- Is SM&CR working?

- FMIs, Get set for SM&CR

- SM&CR: an update for FMIs

- HR & Compliance – Bridging the Gap in SMCR

From SM&CR to SEAR — Schedule Your Call Today!

Book a discovery call to see how Ruleguard’s intuitive platform simplifies the complexity of compliance, enabling you to assure your Board and Stakeholders in an effortless way.

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)