%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

With the draft Pension Dashboard Regulations 2022 published earlier in 2022, we now see a large scale collaboration between various parties ahead of the phased implementation plans.

The pension dashboards are set to improve how we plan for retirement in several ways including:

- Providing an overview of all pensions pots in one secure location

- Improving savers' understanding of the value of all their savings to better estimate retirement income

- Increasing consumer awareness, and

- Promoting greater understanding of pension information and estimated retirement income.

It is hoped that this will result in consumers having better control and ownership of their retirement planning. Ultimately, encouraging better engagement with individuals and leading to better informed decisions when deciding how and when to access these savings; and hopefully, less opportunity for scams to be successful.

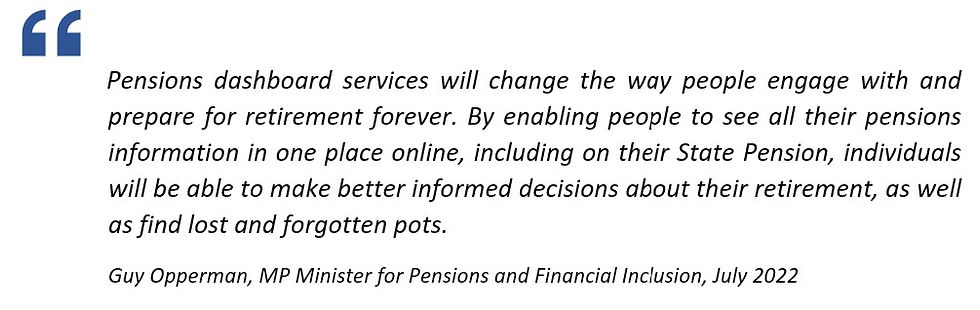

Public support is evident:

Initial research was undertaken on behalf of the Pensions Dashboards Programme (PDP) and indicates that this move is welcomed by many consumers.

The research indicates that:

- 57% of people are likely to use pension dashboards

- 8 out of 10 surveyed have a least one private pension which they could view on a dashboard

- 16% have three or more private pensions

Collaboration required:

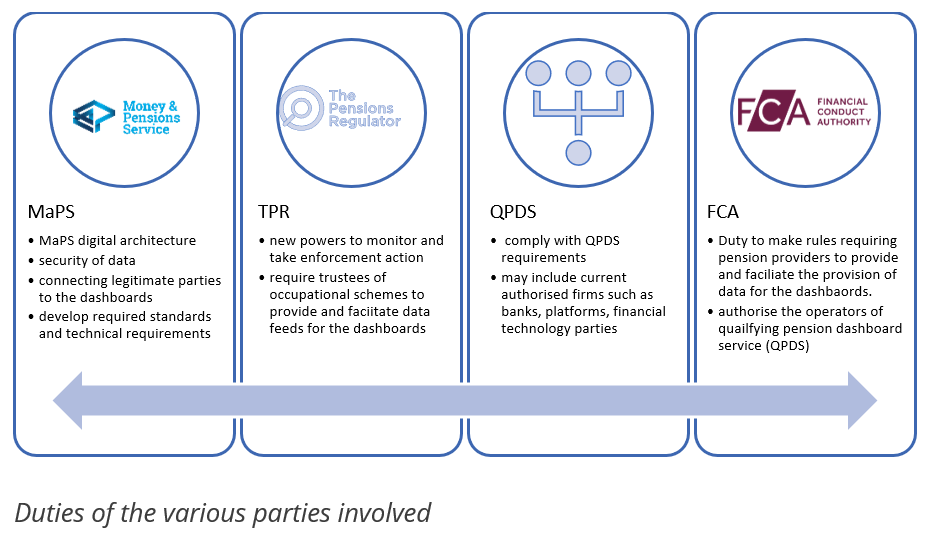

Under the proposed regulations, the delivery of the pension dashboards requires much collaboration between various parties.

The Pension Regulator (TPR) will have new powers to monitor and act against those occupational schemes who don't quite meet the standards. Fines will range from £5,000 to £50,000 for non-compliance.

The FCA will set the rules for the pension providers and authorise the Qualifying Pension Dashboard Services (QPDS). These QPDS are newly established under the Regulations for the purpose of operating dashboards. QPDS would also need to follow the standards set by the Money Advise and Pension Scheme (MaPS).

The MaPS will be responsible for the digital architecture as well as setting the technical, operational and security requirements for the dashboards; including connecting legitimate parties to the dashboards.

Key dates:

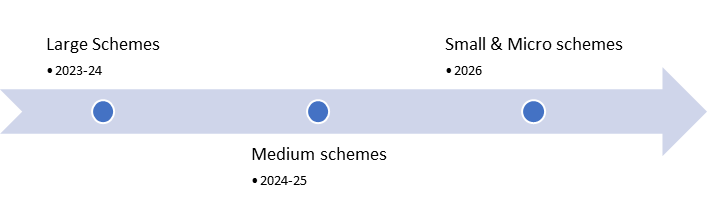

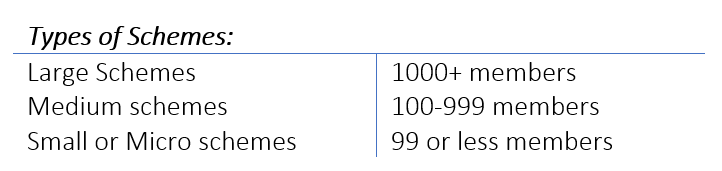

There are three planned phases to implement the requirements. Firstly, the large schemes are scheduled for between April 2023 and September 2024, before moving onto phase two for medium schemes between October 2024 and October 2025. The small and micro schemes are set for a 2026 deadline.

There are a number of challenges to be faced such as:

- Data sharing between multiple parties to collate the information required to provide dashboards initially,

- Ensuring the data is accurate, and over time that data is updated

- Data security and ensuring only legitimate parties have access to the dashboards

- Tight deadlines for connecting data

The first phase will see the large schemes, including Trustees and scheme managers, obliged to connect multiple schemes to the central digital architecture within five months. The challenge here is that some master trust schemes may have 20,000 or more members. For the remaining phases, there is a proposed one-month connection window.

During the connection window, it’s not just a question of data accuracy, but ensuring that the schemes understand the new requirements, have the infrastructure, and the technology to meet the requirements on an ongoing basis.

And, when the time is right, allowing the auditors access to information to validate the data, particularly the pension values and calculations.

The Ruleguard solution

Ruleguard has been designed to help firms demonstrate and evidence compliance, by using its comprehensive rules-mapping, risk and control tools, automated reporting features and powerful dashboards.

With Ruleguard, firms have a seamless control environment between the firm and its third parties for genuine oversight. Ruleguard allows firms to map received data, letting firms to incorporate third party information into a firm’s own risk or monitoring frameworks. For example, firms can generate and automatically maintain compliance documents that reference third party controls – clearly labelled with the provider that operates them – within your account.

This has the ability to radically transform the third party oversight capabilities of a compliance function and allow it to extend best practice beyond the borders of the firm.

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

To learn more, please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

To register your interest or learn more, please click here.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Contact the author

Head of Client Regulation| Ruleguard