%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

This year the FCA has issued a Strategy Document for the next three years to accompany its Business plan for 2022-23. This will be followed shortly by publication of its Data Strategy.

Last year the FCA focused on becoming "more innovative, more assertive, more adaptive". This year we see the FCA keen to act “efficiently, effectively and consistently”.

That’s not to say that last year’s message is to be forgotten. On the contrary, both the FCA’s Strategy and Business Plan indicate its willingness to prevent harmful firms from entering the market, and to remove any that flout the rules.

We will see the regulator becoming more results driven. The FCA has identified 6 core activities to be measured against the FCA’s 13 commitments. It doesn’t stop there. Each of these 13 commitments has an intended outcome for both the FCA and the industry.

In short, the FCA has set out its stall for the next 12 months (& longer term) very clearly and regulated firms need to take note. The next 12 months sees the FCA being more assertive.

FCA’s core activities:

Internally, the FCA will focus on 6 core regulatory activities that represent the end-to-end regulatory journey.

Each of the core activities will be measured against how well that activity enables the FCA to meet its outcomes and key priorities.

FCA’s key priorities:

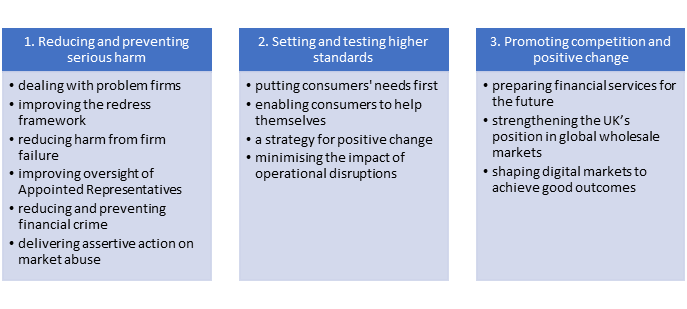

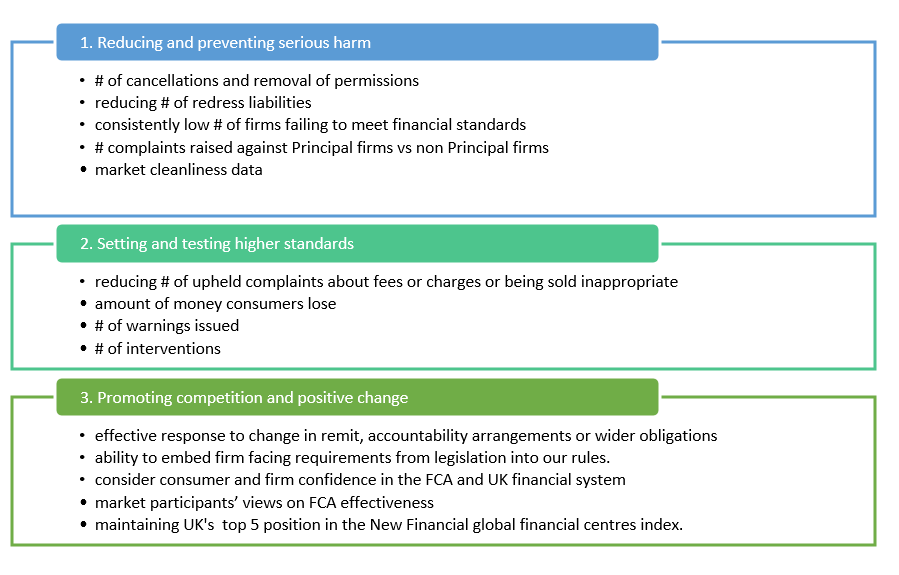

The FCA has three key priorities for 2022/23 aligned to its Strategy.

- Reducing and preventing serious harm

- Setting and testing higher standards

- Promoting competition and positive change

Under each of these priorities, the FCA has indicated 13 commitments. Their purpose is to create conditions that enable firms to meet 13 corresponding outcomes.

The FCA’s success will be measured by its ability to deliver on 13 outcomes that support these priorities.

Business Plan 2022/23: FCA’s 3 focus areas and 13 commitments

Outcomes:

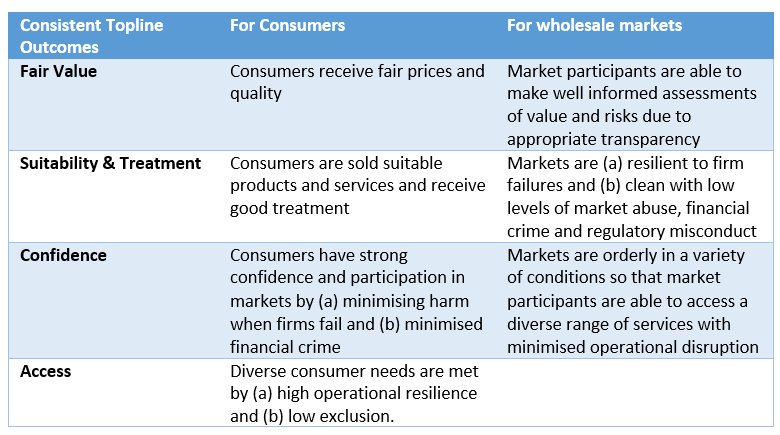

So what are the regulatory expectations for firms? The Strategy document highlights two sets of outcomes:

Consistent topline outcomes: fair value, suitability and treatment, confidence, and access. These outcomes and corresponding metrics relate to both consumer and wholesale firms.

FCA’s 13 commitment outcomes

These commitment outcomes are set over a 3 year period. FCA’s 13 commitments describe how it aims to create conditions enabling industry to deliver the expected outcomes.

FCA intends to measure both its own and the industry’s performance against these 13 outcomes. Information will be gathered from various sources including research, market data and its own internal records.

FCA has clearly indicated its expectations for all firms. Firms now need to review and assess how well they are meeting these commitments: both the topline commitments and the expected outcomes from the FCA’s 13 commitments.

This means reviewing monitoring methodology to ensure that the 13 outcomes are being monitored regularly. Firms should document their reviews and continue reporting to their boards with their findings. Where action is required, this should be highlighted. Where firms are meeting expectations, they should explain how they’ve come to this conclusion.

As always, an audit trail to demonstrate compliance is required. This should be part of the ongoing monitoring and risk management framework for firms.

How Ruleguard can help you:

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance.

The solution is made up of several core modules which can be deployed to provide:

- automation and reduction of compliance risk at different points in the compliance journey

- a holistic platform which delivers end-to-end benefits at every level of a regulated financial services firm.

With Ruleguard, key areas of compliance can be automated and put under direct review by appropriate individuals across the business. This means that monitoring can be embedded directly into business-as-usual processes, vastly simplifying the process and significantly reducing the overhead required to carry it out.

Evidence and approvals are gathered in real time, with responsible individuals signing off attestations within a framework designed for your firm. Documentation reviews and updates are managed automatically. Key compliance workflows can be designed directly within the solution, ensuring that MI outputs are available which directly provide stakeholders with an up-to-the minute overview of compliance results.

Webinars:

Ruleguard hosts regular events.

To register your interest or learn more, please click here.

White Papers:

Request a complimentary copy of our White Paper on Operational Resilience click here.

Further resources:

See our blog page for further articles or contact us via: hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help:

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)