%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

During 2022, the UK Government published its final response on how it aims to enhance the fund regime in the UK. In its publication, the HMT acknowledged the role that the asset management sector plays in our economy.

The UK’s asset management industry is the largest in Europe and the second largest globally. With approx. £11 trillion assets under management, the sector makes a significant contribution to UK Gross Domestic Product and employment.

The government has indicated its commitment to taking steps to boost and enhance this position in relation to two key components of the industry:

- Portfolio management, making decisions on how a fund’s assets are invested, and

- Fund administration, setting up and running fund vehicles, including services such as processing statements and managing investors’ subscriptions & disinvestments.

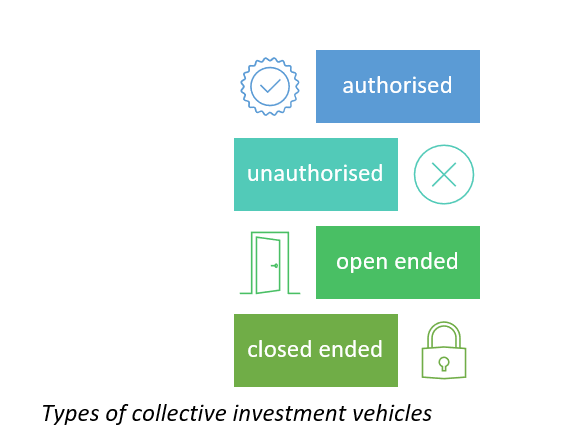

Existing fund structures:

The existing UK funds regime offers a range of different structures:

- authorised and unauthorised

- open-ended and closed-ended collective investment vehicles

all of which have advantages and some compromises according to the target audience.

Additionally, different regulatory requirements apply to each fund type which must be considered when a firm is setting up a new investment vehicle.

Areas for improvement:

The Government’s consultation focused on several potential areas for improvement.

Those of particular interest include fund authorisation, speed to market, and competition. These are considered areas which could be improved to bring greater benefits to the UK.

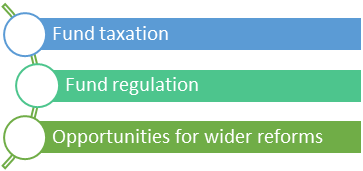

Holistic approach to reforms:

It should be noted that any reforms must be considered along with the stability of the UK’s financial sector, as well as increasing the competitiveness of UK funds.

In this regard, industry feedback on improving competition has highlighted the three areas where coordinated action could reap rewards. These are:

- The UK's approach to fund taxation

- The UK's approach to fund regulation

- Opportunities for wider reform

Fund Taxation:

The industry has been clear in its feedback that a coordinated effort is required as no single factor will improve the UK’s competitiveness on its own. To reach this end goal, the Government is pushing ahead with a new tax regime for certain fund structures as well as introducing a long-term asset fund (LTAF) to enable access to illiquid assets which otherwise would not be available to the retail market.

There is also the addition of a new type of alternative UK investment fund: the Onshore Professional Fund. This new structure is aimed at professional investors and quite separate from Qualified Investor Schemes (QIS), with specific requirements relating to its structure and corporate entities. The introduction of this new fund structure builds upon the existing QIS with the intention of being more attractive to a wider range of investors and encouraging international investment in the UK Funds.

The Government is now looking at additional reforms to boost the UK funds regime by addressing tax inefficiency in the funds regime and deductions for distributions as well as exploring the argument for tax exemptions and tax treaties with other jurisdictions.

UK fund regulation:

In relation to fund authorisation, the following benefits were highlighted:

- Access to retail investors

- Minimum standards of governance, due diligence, and risk management

- Supervisory oversight beyond the regulation of the fund manager and depositary, and

- Regulatory intervention where needed

Investing in authorised funds provides access to retail investors who can't invest in higher risk, more complex structures. Authorisation provides protection and assurance that investments will be processed to market standards. The added supervisory oversight ensures that the regulators can act against firms where harm is likely to be caused to the investor. These are attractive benefits which could encourage new funds to set up in the UK and maintain the UK as a leading hub for financial services.

Speed to Market:

The FCA has set its own voluntary service standards for authorising investment schemes, and whilst there was some discussion around processing times for authorisations, the industry feels the timeframes are appropriate.

Firms feel more improvement is needed to raise awareness of the authorisation process. Improved documentation could take the form of guidance or FAQs for each type of investment vehicle. Greater transparency about the authorisation and regulation processes may help encourage foreign investment in the UK funds.

Currently two thirds of existing financial services jobs are based outside of London. As part of the move to encourage investment in the UK, the Government also wishes to ensure that the benefits of investment are seen across the UK. Linked to the Government’s Levelling Up White Paper, we also see commitment to: building skills, improving connectivity and improving transport.

As part of the move to encourage investment in the UK, the Government also wishes to ensure that the benefits of investment are seen across the UK. Linked to the Government’s Levelling Up White Paper, we also see commitment to: building skills, improving connectivity and improving transport.

As seen above, one of the attractions about our fund regime is the regulatory environment. We have a strong asset management sector that competes globally. Firms should review their compliance and risk management infrastructures. Are there opportunities to make your processes more efficient? How can you improve your oversight of third parties within the asset management sector? What about those parties who are not regulated? How can you gain better oversight and assurance without additional administrative burden?

Firms should review their compliance and risk management infrastructures. Are there opportunities to make your processes more efficient? How can you improve your oversight of third parties within the asset management sector? What about those parties who are not regulated? How can you gain better oversight and assurance without additional administrative burden?

Our Ruleguard solution

Ruleguard has been designed to help firms demonstrate and evidence compliance, by using its comprehensive rules-mapping, risk and control tools, automated reporting features and powerful dashboards.

With Ruleguard, firms have a seamless control environment between the firm and its third parties for genuine oversight. Ruleguard allows firms to map received data, letting firms incorporate third party information into a firm’s own risk or monitoring frameworks. For example, firms can generate and automatically maintain compliance documents that reference third party controls, clearly labelled with the provider that operates them, within your account.

This has the ability to radically transform the third party oversight capabilities of a compliance function and allow it to extend best practice beyond the borders of the firm.

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third-Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com.

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)