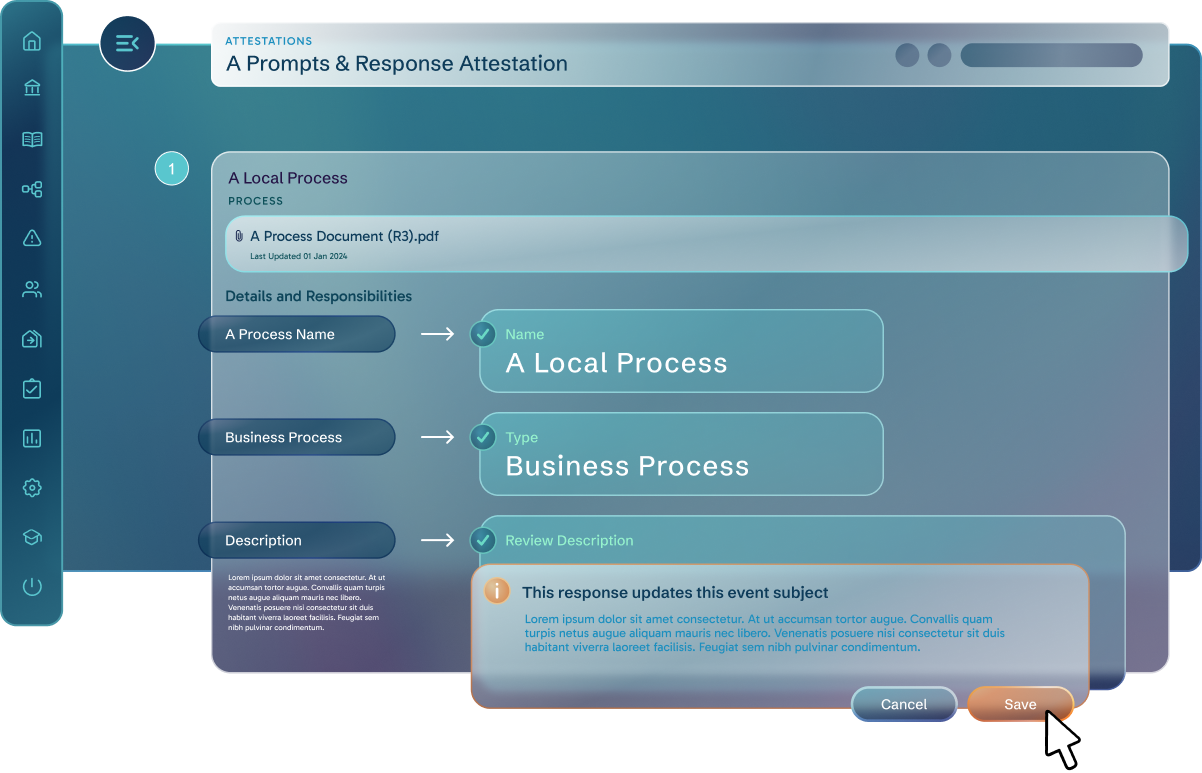

Compliance software for hedge funds

Embed compliance into your culture

Make complying with regulatory obligations effortless with our compliance software for hedge funds. Implement robust internal frameworks, custom workflows, and eagle-eyed third-party oversight.